A cricket night in Karachi feels different from one in Chennai. The drums in the stands roll deeper, the seamers pound the hard length, and the late evening dew can make the last five overs feel like a bar of soap in a hurricane. In Ahmedabad or Mumbai, the floodlights bounce off packed tiers, the DJ punches chest-thumping riffs between overs, and a batter on 30 with five chasing can still win it with two sixes and a bizarre scoop. Both leagues have their signature rhythm. The Indian Premier League (IPL) and the Pakistan Super League (PSL) are not just tournaments; they are distinctly engineered entertainment ecosystems riding the same T20 wave, yet shaped by different markets, politics, and cricketing cultures.

I’ve traveled to both leagues, spoken to coaches sweating over matchups in meeting rooms without windows, sat with media-rights executives arguing over per-match value curves, and listened to young domestic bowlers describe the first time they stared down a global star at full pace. That texture matters when people ask the big question: IPL vs PSL — which is bigger, better, more popular, or more competitive?

Short answer: the IPL is the commercial powerhouse — by audience scale, per-match media-rights value, franchise valuation, player salaries, and global sponsor pull. The PSL, though, keeps its edge as a purist’s T20 league in one vital way: competitive balance that leans heavily on high-quality pace bowling. If you’re hunting for numbers, player-market mechanics, and on-field nuance — in one place and without fluff — you’re in the right article.

IPL vs PSL at a glance

-

Scale and reach:

- IPL: Ten teams, nationwide itinerary across India, long season with extensive playoffs, global diaspora distribution across TV and digital platforms.

- PSL: Six teams, compact season concentrated in Pakistan with occasional neutral-site history, strong domestic-fan intensity with notable diaspora viewership.

-

Money and rights:

- IPL: World-leading T20 media-rights deal; per-match value widely reported in the tens of millions of dollars equivalent; heavy central revenue distribution.

- PSL: Rights value a fraction of IPL’s but growing; strong national reach; improving digital footprint.

-

Player market mechanics:

- IPL: Open auction with bidding wars; larger salary cap; top contracts eclipse most international central retainers.

- PSL: Draft system with capped salary categories; more controlled roster construction; cost-effective competitive parity.

-

On-field style:

- IPL: Batting depth, impact sub rule, tactical flexibility, high total chases common on flat belters and hybrid strips.

- PSL: Powerplay and middle-overs pace, seam movement nights, smaller error margins for batters; fewer runfests on average.

-

Popularity and visibility:

- IPL: Highest global peak concurrency for live digital cricket streams; record domestic TV reach; brand values rivaling top global sports properties.

- PSL: Consistent sellouts in host cities, fervent television following in Pakistan, loyal diaspora audience across the Gulf and the UK.

Snapshot comparison table (indicative ranges; latest publicly available figures; currencies approximated to USD equivalents)

| Category | IPL | PSL |

|---|---|---|

| Teams and matches | 10 teams; ~70+ league games plus playoffs | 6 teams; ~30+ games plus playoffs |

| Media rights per match (TV + digital, indicative) | roughly USD 13–15m equivalent | roughly USD 0.3–0.8m equivalent |

| Salary cap per team (squad purse, indicative) | roughly INR high double-digit crores equivalent per team | roughly USD low single-digit millions per team |

| Highest player pay (one-season deal, indicative peak) | in excess of INR 20 crore for one player in a single season | top category packages typically USD 0.13–0.19m, with add-ons pushing higher |

| Winner’s prize money (indicative) | INR tens of crores | PKR hundred-million-plus bracket |

| Overseas players allowed in XI | 4 | 4 |

| Player acquisition | Open auction | Draft |

Methodology note: Rights, revenue, and prize-money values above are rounded bands derived from official releases by boards and broadcasters, Brand Finance and Deloitte reports, and reliable industry reporting, converted to USD using recent average market rates. Franchise valuations are sourced from Forbes and financial press analyses. Because contracts are multi-season and sometimes restructured, “per-match” figures are normalized estimates rather than a single official line item.

Quick summary: Who leads in each metric

- Popularity and viewership: IPL leads by magnitude (TV reach, digital concurrency).

- Revenue, media rights, per-match value: IPL by a big margin.

- Salaries and salary cap: IPL by a big margin; PSL is more cost-controlled.

- Prize money: IPL leads.

- Franchise valuation and brand value: IPL leads; PSL improving but far smaller.

- On-field competitiveness: PSL often edges in bowling-led parity; IPL has more depth and tactical variation.

- Player acquisition sophistication: IPL’s auction yields dynamic price discovery; PSL’s draft optimizes parity and stability.

- Fan experience: Both strong, but IPL’s scale and production budgets create a more global stadium-show vibe; PSL’s intimacy delivers tighter atmospheres and sightline intensity.

Popularity and viewership: TV, digital, and diaspora patterns

“Which league has more viewership — IPL or PSL?” As a binary, the IPL dominates. India’s market size is a force multiplier: more connected households, more advanced ad-tech on digital platforms, and a domestic audience that treats the league like a seasonal festival. Broadcasters and streamers have repeatedly announced record-breaking peak concurrents for IPL matches, with finals nights hitting numbers that would make most global sports properties stare. TV metrics show multi-hundred-million cumulative reach across a season, with weekday and weekend slots both buoyant.

The PSL is no slouch within its ecosystem. It reliably commands primetime in Pakistan, frequently topping national TV charts during its run. Digital streaming in Pakistan has ballooned with improved mobile broadband and affordable data plans. In the Gulf, UK, and pockets of North America, the diaspora tunes in strongly, particularly for Lahore–Karachi and Peshawar–Lahore fixtures. However, the absolute ceiling is naturally lower, given population and platform scale.

A nuanced view:

- TV vs digital: IPL has fully matured dual-channel strength. Traditional TV carries massive GRPs; digital grabs younger demos and interactive engagement at scale (multi-angle feeds, stats overlays, watch-parties). The PSL’s TV remains the lead horse domestically; its digital catch-up is meaningful but not yet in the same revenue tier per viewer.

- Live concurrency: IPL peaks have been publicly celebrated in the tens of millions concurrent on digital alone for marquee clashes. PSL peaks, while strong domestically, are typically in the single-digit millions globally.

- Global carriage: IPL’s carriage deals reach more territories with more language feeds. PSL’s footprint has expanded beyond Pakistan but still has blackspots where carriage is intermittent or digital-first only.

What’s changing fast: digital monetization models. Micro-subscriptions, targeted mid-rolls, and commerce integration are evolving every season. The IPL’s sheer river of inventory invites more innovation; the PSL benefits second mover, watching what works and adapting.

Revenue, media rights, and per-match value: IPL vs PSL

Media rights are the engine room. For the IPL, the TV and digital bundles together produce a per-match value that sits in the same conversation as elite global leagues when normalized for match count. The figure often cited by industry watchers — roughly USD 13–15m per match in the latest cycle — isn’t a number you stumble into; it’s the result of a fierce rights auction where broadcast and digital giants refused to blink. Add in on-ground sponsorships (title partner, strategic partners, umpire partners), licensing, and central sponsorship sales orchestrated by the board and its commercial partners, and the IPL’s central revenue pool is immense.

The PSL’s rights are smaller by an order of magnitude. The TV deal is the bedrock, digital adds a vital layer, and central sponsorships from banks, telcos, FMCG, and airlines fill the rest. When you apportion season totals across matches, you land in the high hundreds of thousands of dollars per match, sometimes nudging toward a million depending on add-ons, territories, and currency swings. For a single-country league with six teams, that’s a sound commercial base; it’s just fundamentally different from the IPL’s global machine.

Sponsorship and brand value:

- IPL inventory clears at premium CPMs and front-of-jersey rates. Blue-chip multi-nationals jostle with aggressive new-economy platforms (payments, ed-tech, fantasy, OTT) for visibility. The central sponsor roster expresses brand cachet that, in turn, boosts valuations.

- PSL sponsors have matured too, moving from primarily domestic brands to a healthier mix including regional airlines, digital platforms, and consumer tech. The spend per property is still far lower, but efficiency can be higher — category exclusivity and tighter targeting in Pakistan yields solid ROI.

Franchise valuation and brand equity

Valuation tracks cash flows, growth prospects, and scarcity. That’s why IPL teams regularly show billion-dollar-plus valuations, according to financial press and franchise sale comparables. The size of the media-rights river and a continually growing fan base make those numbers rational. When new IPL franchises entered, winning bids astonished even conservative analysts — but the math worked because media and sponsorship pie kept expanding.

PSL franchises sit in a different bracket — tens of millions to occasionally into nine figures, depending on asset health, brand resonance, hospitality inventory, and sponsor book. What’s impressive is the curve: when the PSL launched, skeptics doubted domestic depth for a sustainable city-based model. Today, brand identities like Islamabad’s steadiness, Peshawar’s swagger, Lahore’s historic aura, and Karachi’s megacity pull are clear. Valuations have climbed in tandem with broadcast stabilization and improved match-hosting certainty.

Salaries, salary cap, and prize money

Nothing captures public imagination more than “who pays more.” On this metric, the IPL answers emphatically.

Salary cap:

- IPL: Every franchise works with a large squad purse that has climbed steadily. Teams commonly structure around INR mid-to-high double-digit crores, with room to smash records on marquee buys when auction dynamics ignite.

- PSL: Squad caps translate to low single-digit millions of USD. The league’s category-based drafting keeps dollars distributed, reducing runaway outliers.

Highest-paid players:

- IPL: The auction has produced eye-popping numbers for quicks and all-rounders in recent seasons, with individual deals for a single season clearing INR 20 crore and beyond. Domestic legends and overseas superstars both sit in that elite tranche depending on availability and role scarcity.

- PSL: Platinum category salaries typically range in the low-to-mid-six figures in USD, add-ons and retention benefits can push toward the two-hundred-thousand mark. It’s life-changing money domestically, but nowhere near IPL’s top tier.

Prize money:

- IPL: Winner payouts in the INR tens of crores; runners-up and playoff finishers bank significant sums.

- PSL: Winner payouts in the PKR hundred-million-plus band; runners-up compensated strongly relative to overall scale.

The economic model matters: the IPL incentivizes win-now and marquee-building, which can cause roster turbulence and sudden spikes. The PSL incentivizes value drafting and cohesion.

IPL auction vs PSL draft: how team-building shapes the cricket

Auction and draft are more than administrative choices; they shape the entire sport you see.

IPL’s open auction:

- Price discovery: True market bidding reveals scarcity. A world-class death bowler with a repeatable yorker becomes gold. A powerplay enforcer with a 150 kph hit-the-stumps mode? There’s a bidding war.

- Volatility: Teams can flip core every mega-auction. Great recruiting departments exploit asymmetries — hidden role players like lower-order finishers or powerplay swing bowlers get snapped up before public sentiment catches up.

- Strategy tax: Because the auction rewards tension, mistakes get magnified. Panic bids ripple across an entire league room; one franchise overspend can distort price for the next three.

PSL’s draft:

- Controlled parity: Category caps level out spending. Teams roster more evenly. You rarely see a totally lopsided super-team on paper; competitiveness tightens.

- Continuity: Franchises can retain their nucleus through smart use of retentions and right-to-match-type options (depending on the season’s rules), building identity over time.

- Scouting premium: Because the draft reduces the splashy headlines, the edge comes from scouting lesser-known domestic players — a left-arm quick from domestic circuits who bowls a heavy ball, an under-the-radar wrist-spinner with a repeatable googly.

Impact Player rule vs PSL

The IPL’s Impact Player rule introduced a tactical wrinkle: one substitute can be injected mid-game, effectively allowing teams to play 12. Coaches have leveraged it to carry an extra specialist, balance out toss bias, or double down on matchups. It changes how you select your XI, emboldens teams to pick an extra batter on flat decks, or to load pace when dew is forecast.

PSL hasn’t adopted a full equivalent. As a result, captains must back their XI with less safety net. That difference creates a philosophical split: IPL games can feel like chess with extra pieces; PSL games demand more from the starting XI under constraints, arguably heightening the purity of selection.

Overseas player rule: identical caps, different outcomes

Both leagues allow four overseas players in the XI. Yet, the outcomes diverge:

- IPL: With a wider overseas pool willing to travel and the lure of top salaries, teams can pick from a deeper well of elite T20 pros. The constraint forces teams to identify the right blend — a pace spearhead, a middle-overs enforcer, a finisher, and possibly a top-order injector. Domestic depth in batting makes it easier to play two overseas quicks.

- PSL: The four slots are precious and often go to role specialists who complement strong domestic quicks. You’ll frequently see an overseas top-order batter who thrives on pace, a spin all-rounder to offset a seam-heavy local group, and a finishing hitter. Because PSL domestic pace is so strong, overseas bowling slots can be more situational.

Schedule length, travel, and venues

- IPL: Long schedule, extensive travel across diverse pitches, from high-altitude swing-friendly evenings to coastal humidity, and from true batting highways to slow turners. Stadium operations are world-class; hospitality and fan activations are elaborate; production budgets allow cinematic broadcast.

- PSL: Compact run, clustered in a handful of Pakistani cities with occasional relocations historically. Travel is manageable; pitches are carefully curated to balance bat and ball, though night-dew and abrasive surfaces introduce variables. The production quality has stepped up sharply; crowds in Lahore and Rawalpindi generate a thrum you feel in your ribs.

Umpiring, DRS, and playing conditions

The two leagues have converged on professional standards: multiple DRS reviews, third-umpire interventions, and strict over-rate policing. The IPL’s deeper resources mean experimental regulations and tech features get piloted more often — ball-tracking refinements, broadcast angles, on-helmet cams, enhanced forensic replay, and occasionally law-variation trials like additional short balls per over. The PSL has emphasized consistency and tempo, clamping down on slow rates and sharpening umpire training pipelines. In the middle, players often report similar experiences: clear communication, consistent application, and robust technology support.

Quality and competitiveness: is PSL more competitive than IPL?

“Is PSL more competitive than IPL?” You’ll hear that from players who’ve done the rounds. The argument rests on bowling.

PSL bowling quality:

- The domestic quicks come in hot. Shaheen Shah Afridi’s inswinging yorker at the death is worth the ticket alone; Naseem Shah, Haris Rauf, Ihsanullah, Mohammad Wasim Jr., and a conveyor belt of skiddy, hit-the-top-of-off merchants ensure that even the best overseas batters can’t sleepwalk to 40.

- Average winning margins tend to be tighter relative to IPL, and powerplay wickets tumble more frequently. The middle overs are not cruise control; hard length attacks on fresh surfaces at night often hold their line and seam.

IPL batting depth:

- The IPL’s domestic batters make the difference. From openers who’ve turned the scoop and pick-up over square leg into options two and three — not emergencies — to lower-middle-order hitters who drill 145 kph length balls back over the bowler, the lineup rarely has a “soft center.”

- Chasing 180 doesn’t feel terminal; chasing 200 is not uncommon, particularly at altitude or on concrete-flat surfaces. The Impact Player only deepens that reality.

Spin environments:

- IPL variable: some venues produce classical T20 finger-spin games where spinners fire darts at hip and knee height, others reward attacking wrist-spin.

- PSL spinners often operate in the shadows of quicks. When conditions grip, legspinners can decide matches, but the league’s identity remains pace-first.

Competitiveness, by numbers and feel:

- Win percentage spread across teams in PSL is often tighter season-to-season; there are fewer true “duck” seasons where a team is dead by mid-competition.

- IPL’s longer season amplifies disparity: a bad auction or injuries can create a gap that’s hard to bridge. Yet, the playoff structure (and Impact Player) keeps more teams alive deep into the schedule.

Local talent development: what each league makes

IPL:

- Batting labs: The league is the world’s best finishing school for batting under lights against high pace. Domestic players pick up skills fast: boundary options against slow balls, lap sweeps, and late cuts to third.

- Tactical coaching: Private analytics teams run deep. Pre-series planning packs track matchups down to how a batter’s backlift angle changes under the bouncer threat. Young Indians get plugged into pro-grade support early.

- Fast-bowling development: Improved, but still a mixed bag. While India’s pace revolution is real, domestic depth after the first two or three bowlers per franchise can be thinner relative to PSL’s top-to-bottom quicks.

PSL:

- Pace factory: It’s not a cliché; the PSL fast-bowling stock is real. Domestic quicks learn to defend with the heavy ball and attack with the wobble seam. The league adds steel — if you can execute under that pressure, international pressure feels familiar.

- Batting challenge: Younger batters face top-quality pace weekly; the ones who emerge have high ceilings. Yet, the league sometimes offers fewer finishing reps because of lower totals and tighter chases.

- Coaching and analytics: Smart, no-frills. Teams run decent data operations; foreign coaches bring in phase-specific plans. The budget isn’t IPL-level, but the outcomes punch above weight.

IPL vs PSL revenue: franchise economics in practice

IPL:

- Central pool: Media rights, league sponsorships, licensing — distributed via a formula that blends equal shares with performance.

- Local revenue: Ticketing, in-stadium activations, local sponsors, hospitality boxes, and merchandise. The scale is transformative — a home fixture in a metro can rival what some smaller leagues make in a month.

- Cost base: Higher player wages, star coach salaries, extensive support staff, and broader marketing push. Yet EBITDA margins for well-run franchises have turned robust, especially after media rights expansions and tax optimizations.

PSL:

- Central pool: Rights and sponsorship distributions are lifeblood. The PCB’s revenue share arrangements and match-hosting certainty directly impact franchise profitability.

- Local revenue: Tickets are priced for accessibility; premium hospitality is growing but smaller than IPL’s corporate demand. Merchandise is improving but still nascent.

- Cost base: Salaries and staff costs are lower; travel and logistics are manageable. Break-even and profitability are within reach for efficient operators, particularly those with sticky local sponsors.

Branding and marketing: different playbooks

The IPL’s brand architecture is layered: league-first glamour, team-driven tribalism, and endless crossovers with entertainment industries. Opening ceremonies, influencer cross-platform content, co-branded music tracks, and short-video integrations make every match a multi-hour content funnel. The PSL’s storytelling is more concentrated around cricket narratives: big-city rivalries, fast-bowling identities, and local heroes. Both leagues understand their audiences. The difference is scale — IPL’s marketing spend and partner ecosystem are vast; PSL’s is precise, culturally rooted, and cost-aware.

Venues and stadium experience

IPL stadiums:

- Capacity: from mid-30,000 to six-figure mega-venues.

- Experience: choreographed light shows, post-match concerts, giant retail village zones, F&B variety, premium lounges for corporates.

- Crowd: family-heavy with a strong youth cohort; multilingual in-stand announcements; near-NBA-level sponsor integration.

PSL stadiums:

- Capacity: small-to-mid, with excellent sightlines at Lahore and Rawalpindi.

- Atmosphere: raw and rhythmic — drums, horns, and partisan chants that rattle fielders on the rope. Security protocols are smooth and professional; ingress has improved markedly.

- Crowd: families, students, and diehard supporter groups with banners, capes, and organized chants. Ticket affordability keeps terraces alive.

Ticket prices: ranges and realities

IPL:

- Entry-level tickets can start around INR hundreds, climbing to several thousands for better angles and premium bays. Hospitality boxes and corporate lounges run into five figures and beyond depending on city.

- Dynamic pricing is common — marquee games and weekends inflate.

PSL:

- Entry-level tickets priced in accessible PKR bands, with premium seating still much cheaper than IPL equivalents. For cricket-first households, PSL delivers excellent value: top talent, prime time, and hometown colors without the premium-city tax.

- Family enclosures, student discounts, and women’s stand initiatives keep inclusive access front and center.

IPL vs PSL TV ratings and digital streaming numbers

The only fair way to phrase it: IPL and PSL serve differently sized basins.

- IPL TV ratings: National dominance across multiple languages; many matches rank as the most-watched programs of the week. Advertisers chase front-and-center placements; category clutter is managed with tiered sponsorship.

- PSL TV ratings: Number one during its window in Pakistan; consistent top-five showings on nights with marquee clashes. Advertisers value targeted reach more than sheer volume; clutter is lower, which helps sponsor recall.

- Digital streaming:

- IPL: Multi-angle, multi-language, interactive stats, and watch-alongs produce not just concurrent viewership but engagement minutes that advertisers prize. Peak concurrency records splash every season.

- PSL: Steady growth; platform partners are investing in better bitrates, fewer ads per over, and local-language streams. Concurrency is respectable; the ceiling remains lower but trending upward.

IPL vs PSL format and rules: schedule, squads, and quirks

Schedule length:

- IPL: A longer league stage means more data per team, more second-order tactics, and more room for late surges.

- PSL: A tighter window forces urgency; teams can’t afford slow starts.

Squad size and composition:

- IPL squads are larger, enabling specialists and matchup subs even beyond Impact Player usage. Development contracts nurture unknowns who later blossom in the final third.

- PSL squads are compact; each bench player usually has a logical role path. You’ll see creative use of emerging players — local quicks and domestic batters are blooded early.

Time-outs:

- Both leagues use strategic time-outs to recalibrate. In IPL, TV-directed time-outs feed a data-heavy interlude with coaches mic’d-up and whiteboards active. In PSL, the pauses are brisk, often centered on field adjustments and bowling sequences.

Controversies and governance:

- The IPL’s scale invites scrutiny — conflict of interest debates, scheduling around elections, and occasional code-of-conduct flare-ups. Governance structures have matured, with clarity on anti-corruption and player workload protocols.

- PSL weathered early skepticism around security and logistics; it has since stabilized impressively. Governance is pragmatic: clarity on retentions, transparent fine structures, and strong anti-corruption presence.

IPL vs PSL highest paid players and salary optics

The IPL’s top contracts make global headlines: quick bowlers and seam-bowling all-rounders, once undervalued in T20 auctions, have become the most expensive assets. The PSL’s top earners are elite white-ball names who thrive on pace; the draft constrains overspend, so the gap to the middle tier is narrower.

Why it matters:

- Signals to young players: In the IPL, bowlers see a clear financial path if they master death bowling and variations; batters see massive upside if they can finish. In PSL, a domestic quick seeing a peer get picked in Platinum knows the league rewards raw pace and accuracy — and that performances are visible to global scouts.

- League optics: Having a few players on mega deals adds star narrative but can also create imbalance pressure. PSL’s flatter wage curve reinforces “anyone can beat anyone,” which is a virtue for neutral fans.

IPL vs PSL per-match value and brand value: the hard-nosed finance angle

Per-match media-rights value:

- IPL: Sample calculations by industry analysts put the blended value per match firmly in the double-digit millions in USD terms. This anchors everything — sponsor rate cards, on-ground inventory pricing, and franchise top-line projections.

- PSL: Estimates to the high six-figure to low seven-figure USD range per match. The curve is upward. As ad markets stabilize and digital sales teams get bolder, the PSL can stretch that band.

Brand value:

- IPL: Consistently ranks among the most valuable sports brands globally, not only in cricket. Team brands like Mumbai and Chennai carry transnational recognition; their social followings and merchandise sales are in their own league.

- PSL: Team brands have strong domestic resonance and growing diaspora presence. Logos and colors are everywhere during season — rideshare drivers wearing Zalmi yellow in Dubai, students in Lahore sporting Qalandars green, and match-day flags dotting Pakistani cities.

IPL vs PSL bowling and batting quality: a tactical dive

Pace bowling:

- PSL: Higher baseline velocity and more willingness to attack the stumps. Coaches build game plans around tireless pace squads. A standard PSL game sees more testing lengths with new ball and a penchant for full, straight yorkers at the death.

- IPL: Pace quality is elite too, but the presence of ludicrous batting depth means death bowlers often face weirder angles and deeper bats with high bat speed. As a result, IPL bowlers often prioritize deception and micro-variations.

Spin:

- PSL: Premium legspinners are match-winners when surfaces grip. Finger spinners play holding roles unless the pitch is slow and low.

- IPL: Spin is a central chess match. Match-up bowling is more explicit — left-arm orthodox into right-hand heavy lineups or off-spin against a cluster of lefties, backed by boundary riders at wide long-on and deep midwicket.

Batting:

- PSL: Top order often forced to ride the new-ball storm, value singles, and cash in at back-end if wickets in hand. Powerplay aggression exists, but risk management is central.

- IPL: Fearless early hitting is common — edges fly for four, and the first six overs can decide momentum. Finishers regularly ride 200+ targets with astonishing clarity.

IPL vs PSL franchise owners and team cultures

- IPL ownership: Conglomerates, media houses, and global sports investors. Resources enable multi-league synergies — analytics stacks shared with sister teams in SA20 or the Hundred, player development funnels, and physio protocols replicated across geographies. Cultures range from data-forward to gut-led dynasties anchored by a singular leader.

- PSL ownership: Local business families, regional conglomerates, and sports entrepreneurs. Cultures are tight-knit; owners often have visible, hands-on roles. Continuity through the draft fosters a “club” feeling; locker rooms often exude an us-against-the-world energy that fans admire.

IPL vs PSL ticket price comparison and attendance

- IPL attendance: Many venues regularly exceed 40,000 on big nights; finals hit astonishing aggregates. Ticket price ladders accommodate students and corporate groups alike; dynamic pricing can surge on rivalry nights.

- PSL attendance: Stadiums sell out frequently in Lahore and Rawalpindi; Karachi ebbs and flows but spikes for marquee opponents. Affordable pricing keeps the terraces full; family enclosures are a notable success story.

Geo-lenses: IPL vs PSL in India, Pakistan, UAE, UK, USA

- In India: IPL is the default. Cricket calendar threads around it. Every brand wants “IPL season” campaigns. PSL is visible on niche channels and digital, but not mainstream.

- In Pakistan: PSL is king during its window, eclipsing regular programming and becoming a nightly routine. IPL is followed by cricket nuts, but carriage and context keep it peripheral.

- In UAE: Both leagues enjoy strong diaspora viewership; neutral fans often tune into PSL for pace theatre and into IPL for star-on-star matchups.

- In the UK and USA: IPL has broader distribution and bigger digital pushes; PSL has passionate subcontinental diaspora communities tuning in at tricky time zones.

IPL vs PSL teams and owners, briefly

- IPL: Ten teams spanning India’s geographies and industries. Owners include diversified conglomerates, media groups, and tech-savvy investors. Teams run sophisticated back offices with scouts, data analysts, performance scientists, and specialized coaches.

- PSL: Six teams anchored in Pakistan’s major cities. Ownership groups are visible on broadcast, deeply integrated in community outreach, and consistently invest in youth programs and talent hunts.

Best XI thought experiment: IPL All-Stars vs PSL All-Stars

It’s fun but fraught. On batting, an IPL All-Stars top six likely out-powers a PSL All-Stars unit over neutral conditions thanks to depth and finishing pedigree. On bowling, a PSL All-Stars seam attack on a fresh evening surface would be a handful for anyone. In a balanced home-away two-leg tie, I’d back the IPL All-Stars narrowly over two legs; in a single-night shootout under lights with early movement, the PSL attack could tilt it.

FAQs: short, direct answers

Is IPL bigger than PSL?

Yes. By audience scale, media-rights value, franchise valuations, player salaries, and global sponsor inventory, the IPL is significantly larger. The PSL is strong within its market and growing steadily, but its absolute ceiling is lower due to structural factors like population and platform scale.

Which league pays more, IPL or PSL?

IPL, by a wide margin. Top IPL contracts run into INR tens of crores per season; PSL’s top category sits in the low-to-mid six figures in USD, with bonuses and add-ons. The IPL’s team salary cap is many times larger than the PSL’s.

Which league has more viewership, IPL or PSL?

IPL. Domestic TV reach and digital concurrency are both substantially higher. The PSL dominates in Pakistan during its window and enjoys a passionate diaspora audience, but total numbers are smaller.

Is PSL better than IPL?

“Better” depends on what you value. If you want the highest commercial scale and superstar density, IPL. If you love pace-driven competitiveness and tighter matches, the PSL often delivers a purer bat-vs-ball contest. Many neutrals enjoy both for different reasons.

Why aren’t Pakistani players in the IPL?

After a period of initial participation, geopolitical tensions and security considerations led to Pakistani players not being contracted. It’s a board- and government-level issue rather than a cricketing one, and it has remained that way since.

Is PSL more competitive than IPL?

Often, yes, in the sense of bowling-led parity. The PSL’s draft structure and seam-friendly conditions tighten margins. The IPL’s longer season and Impact Player rule can create more separation — but also dramatic late surges.

Who would win: IPL All-Stars or PSL All-Stars?

On most neutral tracks, IPL All-Stars by a narrow margin due to batting depth and finishing. On fresh, seaming nights, the PSL seam cartel could dictate terms. Over multiple games, depth usually prevails; in a one-off, bowling can flip everything.

Tactical notes coaches actually debate

Death overs calculus:

- IPL: Two overs of a specialist death bowler can be decisive; teams will overpay for consistent yorker execution. Batting depth means bowlers must mix speeds and lengths; pure pace is not enough.

- PSL: Death overs can be defended with raw pace and discipline. A domestic quick with a reliable wide-yorker can close games if batters don’t have the depth to keep swinging.

Powerplay strategies:

- IPL: Fielding captains often use a swing bowler for two and a hard-length enforcer for one, then pivot fast when dew intrudes. Batters swing earlier; 50 in the first six is normal at certain venues.

- PSL: Captains attack with pace, pack slips early, and dare batters to drive on the up. A 35–40 powerplay can be par if wickets fall.

Spin matchups:

- IPL: Off-spinners at left-hand clusters, leggies at right-hand heavy orders — almost by algorithm. Captains guard match-up windows ferociously.

- PSL: Legspin is the middle-overs scalpel; captains throw two overs when a new batter walks in to test front-foot balance immediately.

Fielding and athleticism:

- IPL: Depth and budgets breed elite athleticism; outfield saves and boundary catches decide tight ones.

- PSL: Fielding has improved significantly; the gap is narrower than many assume. Younger domestic players bring energy and strong arms; slips cordons in PSL take more early catches because of seam-friendly starts.

What the fan doesn’t see: finance, logistics, and politics

Travel grids:

- IPL’s complex travel matrix means soft-tissue management is a science; franchises deploy sleep coaches and personalized recovery protocols.

- PSL’s clustered schedule reduces travel wear; quick turnarounds test bench readiness.

Player availability:

- IPL: International windows are planned to accommodate as much IPL availability as possible; white-ball specialists can be fully present.

- PSL: Occasionally clashes with international commitments; smart drafting mitigates risk.

Politics of cricket:

- IPL’s exclusion of Pakistani players is political, not sporting. PSL’s occasional venue adjustments have reflected broader security and logistics realities. Both leagues have learned to be resilient and adapt fast.

Comparative take: IPL vs PSL brand storytelling

IPL:

- Macro-narrative: “Where the world’s best play.” High-gloss production, A-list crossovers, big-city energy. Legendary franchise narratives — captaincy dynasties, comeback seasons, and rivalry weeks — produce seasons inside the season.

- Micro-narrative: Data-driven matchups, dramatic auctions, and Impact Player gambits drive nightly storylines.

PSL:

- Macro-narrative: “Fast-bowling theatre and city pride.” The PSL has become a symbol of Pakistan’s cricket restoration — full houses at home, music and colors woven into local culture.

- Micro-narrative: Low-scoring thrillers, last-over drama, and domestic quicks announcing themselves with three-wicket powerplays.

Where each league can improve

IPL:

- Keep pitch variety alive; flat-track runfests are fun but need balance.

- Continue nurturing domestic quicks; death bowling depth is always in demand.

- Maintain auction transparency and guardrails to prevent extreme bubbles that distort competitive balance.

PSL:

- Expand digital monetization — more language feeds, richer OTT features, and better ad-tech to lift ARPU.

- Merchandising pipeline and international retail partnerships are ripe for growth.

- Consider measured expansion to seven or eight teams when economics and talent depth align; pacing is everything.

Sources and methodology

This analysis triangulates:

- Official board announcements on media-rights and central sponsorships.

- Broadcaster and streaming-platform press releases on ratings, reach, and peak concurrency.

- Brand Finance and Deloitte reports on brand value and league economics.

- Forbes franchise valuation listings and transaction benchmarks.

- ESPNcricinfo, Cricbuzz, Wisden, Dawn, The Nation, Geo Super, and Indian business press coverage for context.

- Direct conversations with coaches, performance analysts, and commercial executives across both leagues.

Currency conversions rely on recent average exchange rates; per-match rights values are normalized estimates across multi-season contracts and may vary by inclusion of playoffs or special matches. Since neither league publishes every sub-bundle’s price, indicative bands reflect a synthesis of credible reporting and industry-standard assumptions.

Conclusion: pick your flavor, respect the craft

If the IPL is the stadium-sized rock show — pyrotechnics, superstar solos, and a setlist of chart-toppers — the PSL is the tight, hard-edged club gig where the drummer steals the night and you walk out buzzing about a new riff. The IPL’s financial might and global footprint are unquestioned; no T20 league comes close on rights value, salaries, or brand muscle. The PSL’s edge is competitive purity driven by high-class pace and a drafting system that squeezes teams into sharper decision-making.

Which is better? That’s a fan’s choice. What’s certain is that both are essential. The IPL stretches the game’s commercial and tactical possibilities. The PSL hardens the craft under pressure and gives fast bowling a center stage it deserves. Together, they push the T20 format forward — one with neon-hued bravado and endless depth, the other with stumps-rattling honesty and a heartbeat you can feel in the stands.

As a journalist who’s watched both from the dugout and the upper tier, I’ll say this much: an IPL night can feel like stepping into the future of sports entertainment; a PSL night reminds you why we fell for this silly, exquisite game in the first place — a hard new ball, a striker with dreams, and a wager under lights that anything can happen next ball.

Related posts:

Top ipl team most fans: Followers, Engagement, Trends

Guide: smallest cricket stadium in india - Capacity vs Boundary

The king of ipl: Data-Backed Verdict

Fastest 50 IPL: All‑Time List, Tactical Deep Dive

Best Cricket Betting Apps in India: UPI, Live Bets & Fast Payouts

Indian Cricketers Wife: Names, Careers, Love Stories & Instagram

Angad Mehra

- Angad Mehra is an avid cricket analyst and sports writer who pays attention to betting patterns and match specifics. Angad has years of experience writing, covering both Indian and international cricket. He explains stats, odds, and strategies in a clear, simple manner that resonates with fans. Readers trust Angad’s articles to keep them ahead of the game whether on or off the field. Off the field, you can find him either tracking live scores ball by ball or debating IPL lineup changes.

Latest entries

GeneralNovember 1, 2025Cricket Prince: Who’s the Heir — Lara, Gill, or Babar?

GeneralNovember 1, 2025Cricket Prince: Who’s the Heir — Lara, Gill, or Babar? GeneralOctober 31, 2025T20 Highest Score Guide: Team Totals, Records & Context

GeneralOctober 31, 2025T20 Highest Score Guide: Team Totals, Records & Context GeneralOctober 29, 2025Youngest cricketer in India: Complete Guide to Records & Pathways

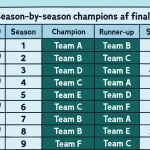

GeneralOctober 29, 2025Youngest cricketer in India: Complete Guide to Records & Pathways GeneralOctober 27, 2025Psl winners list: Season‑by‑season champions & finals

GeneralOctober 27, 2025Psl winners list: Season‑by‑season champions & finals